Brand Awareness, Royal Sussex, and Casper

Good morning everyone,

I hope everyone is enjoying the first few weeks of 2020. Good luck with all of your projects and please drop me a line if you have any questions about marketing strategies.

—Edward

#Megxit

Even if you never follow royal news, you probably heard about Prince Harry and Meghan Markle’s bold declaration. As the Telegraph reported on January 9:

In an extraordinary statement … the couple announced plans to “step back” from their current roles and split their time between the UK and North America.

The decision surprised Buckingham Palace, the United Kingdom, and much of the world. Few stories span both the tabloids and the business papers, but the departure of the Duke and Duchess of Sussex captured headlines around the globe.

The cause for the shocking exit? Royal insiders have suggested the couple grew upset about the different ways the media judged Kate Middleton versus Meghan Markle (a double standard compounded by Markle’s identity as a non-British woman of colour).

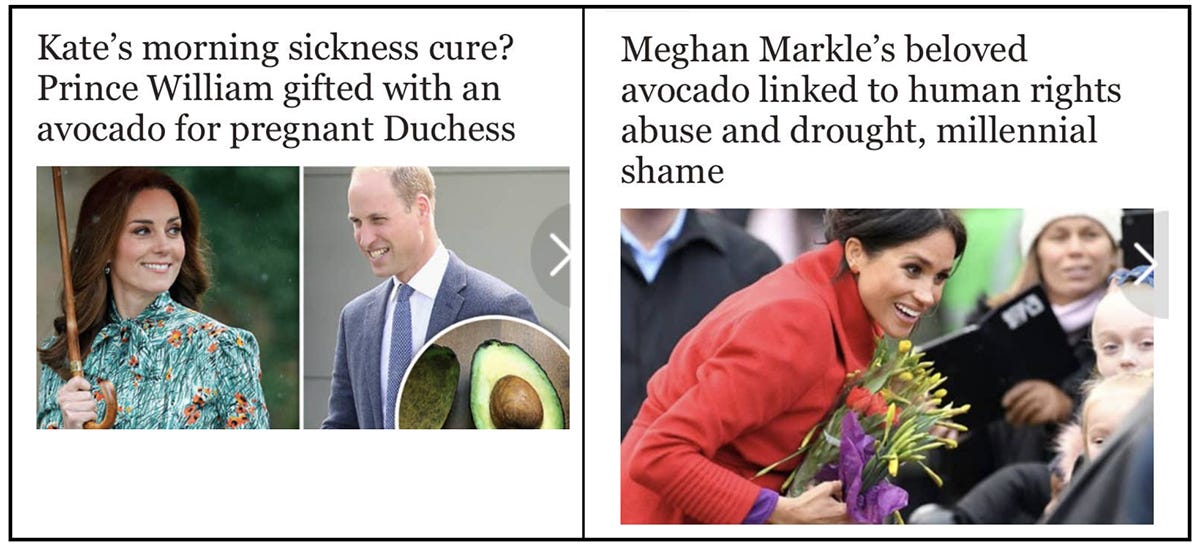

Buzzfeed juxtaposed coverage of Middleton and Markle engaging in nearly identical activities, and the contrast is striking.

No wonder they wanted to leave the royal nest!

The Cost of Independence

For us non-royals, the decision to leave jobs and move cities usually requires a consideration of both personal and economic factors. The same holds true for Harry and Meghan; their public statement includes references to both “providing our family with the space to focus on the next chapter,” as well as a desire “to become financially independent.”

By leaving the royal family, Harry and Meghan will forfeit their share of an annual “Sovereign Grant” paid for by British taxpayers. In recent years, though, the grant provided the relatively modest sum of £100, 000. The lion’s share of their income — approximately £2.3 million per year — has been contributed by the Duchy of Cornwall (a series of estates owned by Prince Charles, Harry’s father). Plus, the Sussexes hold a combined personal net worth of some £30 million, accumulated from Harry’s inheritance and Meghan’s work on the television show Suits.

By “spinning off” from the Royal Family, the Duke and Duchess are giving up significant income. Can they generate equivalent (or greater) wealth by pursuing new opportunities?

The couple’s newly minted website provides more context:

[Harry and Meghan] value the ability to earn a professional income, which in the current structure they are prohibited from doing. For this reason they have made the choice to become members of the Royal Family with financial independence. Their Royal Highnesses feel this new approach will enable them to continue to carry out their duties for Her Majesty The Queen, while having the future financial autonomy to work externally.

Now that Harry and Meghan are empowered to “work externally,” how might they earn money? Over her 15-year career as a television and film star, Markle earned approximately $5 million. Let’s ballpark her potential for annual screen-related income as $500, 000. Harry previously served in the military for 10 years, rising to the rank of Captain. By returning to the same position, he would earn approximately £48,500 (or $63,000 USD).

I kid.

Harry will not be rejoining the military and Meghan will not pick up a recurring role on The Crown. While Harry and Meghan have limited “human capital,” they possess something worth far more: awareness and exposure. As I explained in last week’s letter, advertising can successfully accomplish three things:

1. It makes you AWARE of a product, service, or idea. (Have you heard of a restaurant called McDonald’s?)

2. It helps you CONSIDER a product, service or idea. (Have you thought about eating at McDonald’s for breakfast?)

3. It EXPOSES you to a product, service, or idea. The “exposure effect” is well documented — the more we are exposed to something (all things being equal), the greater our affinity for the thing. (If you’re going for lunch, you have many options. You might choose McDonald’s if you have been exposed to more of their ads than any of their rivals.)

What’s the hardest part about building a brand? Getting anyone to care about you at all.

Dartmouth Alumni Magazine published an interesting profile on Lis Smith, the senior campaign communications advisor for Democratic presidential nominee Pete Buttigieg. Her strategy is straightforward: aim for “maximum exposure.” She continued to reveal more of her perspectives, noting that “the press treats candidates more favorably when they see more of them and not less.” She even organized an appearance of Mayor Pete on Fox News. When questioned about that decision, Smith explained:

“The reason Donald Trump won is because he saturated the media environment. Sometimes he would totally bomb, but even in bombing, he knew he was going to dominate the conversation,” Smith says, before realizing how that sounds and qualifying her hat tip. “That’s a compliment to the strategy, not the man.”

In the case of smaller brands or crowded marketplaces (like 20 Democratic nominees), exposure is extremely important. So much so that I would argue bad PR is good PR.

Any channel or opportunity that provides exposure will help increase your awareness and grow your customer affinity. Few people in the world attract as much exposure, awareness, and affinity as the Duke and Duchess of Sussex. Does anyone really doubt the couple’s ability to earn a lot of money from licencing deals and speaking engagements? Based on conversations with licensing experts, Sky News estimated the couple could earn $650 million in their first year alone.

Rumors abound that Markle has already secured a contract for voiceover work with Disney; moreover, Netflix’s chief content officer expressed a desire to collaborate with the Sussexes.

Harry and Meghan no longer hold the title of His and Her Royal Highness, but they still have the power of awareness.

Going Public

Now that Harry and Meghan are shopping for homes in North America, they’ll need some new furniture. Perhaps they’ll purchase a new bed from one of the many online mattress companies? Probably not. But at least one direct-to-consumer mattress company could provide the Sussexes with a roadmap for building brand awareness in the United States.

On January 10, Casper announced their plans to go public. Filing for an IPO requires the release of an S-1 document, which provides detailed information about the company’s financials. Upon the release of Casper’s S-1, the company was immediately pilloried (or should that be pillowried?). My good friend Jason Stoffer, a partner at Maveron VC, wrote a short Twitter thread on Casper’s financials. Here are some highlights from his analysis:

S-1 drops from @Casper - interesting positioning as a sleep economy business vs a mattress business.

The financials and growth don’t match with the picture of market size. Growth of only 20.2% YoY (nine months ended sept 2019). Increasing operating losses ($65M operating loss!)

At that low 20% growth rate, @Casper should be profitable and showing increased operating leverage.

With a gross margin of 50% and sales and marketing consistent for two years at 36%, they’d need to add almost $500M in additional revenue to break even, even if you unrealistically assume no further increase in G&A. [Emphasis mine]

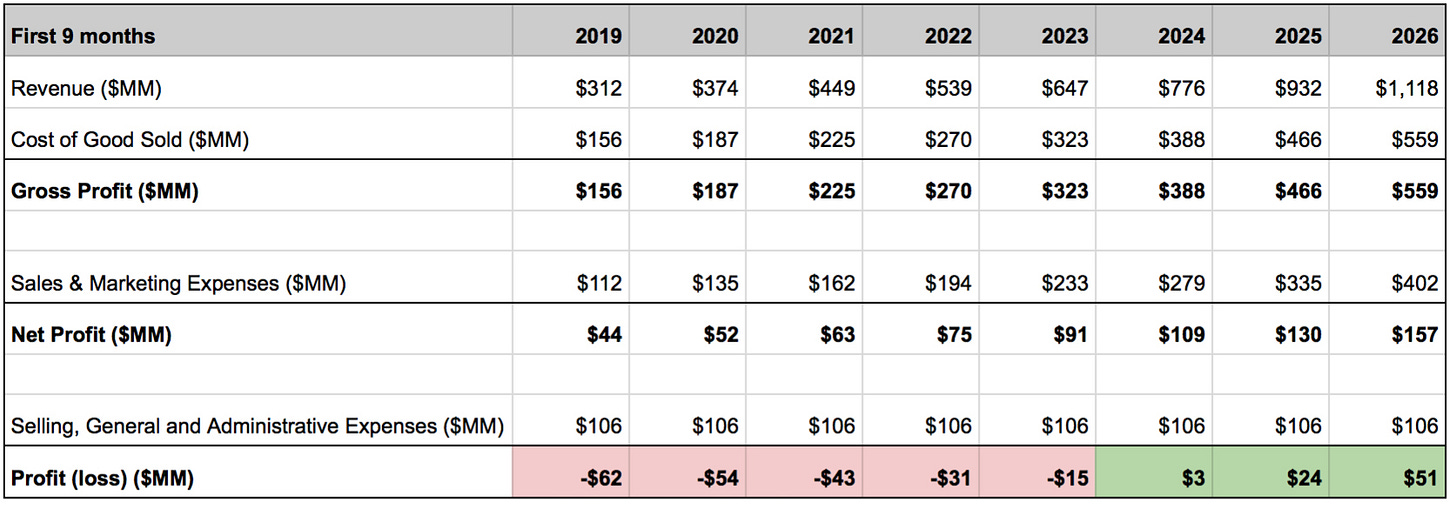

At first glance, this looks like a case study for a bad economic model. Casper sells mattresses with 50% gross margins, but spends 72% of that profit on sales and marketing. That leaves only 14% net margin to cover all their other costs (which totalled $106 million in the nine-month period of January to September, 2019). During that same nine-month timeframe, Casper earned revenues of $312 million, but lost $65 million.

As mentioned in Jason’s Twitter thread, losing money is okay, IF you are experiencing rapid growth. But last year, Casper only grew 20.2%. In the hypothetical world where they (1) continue growing at 20%, (2) maintain their marketing costs as a constant percentage of revenue, and (3) do not add any more overhead costs, it will take Casper until 2024 to show a profit (of just $2.7 million). See the table below for detailed calculations:

Even worse: the hypothetical situation I described above seems improbable. I have never heard of a company keeping their SG&A flat while more than doubling the top line. (Though many administrative costs are fixed, growing companies usually require more accountants, analysts, and lawyers than small companies). In reality, Casper increased their SG&A by 18%-20% in each of the last two years, which basically matched the same rates as their revenue growth. Thus, the company has not been able to demonstrate ANY “economies of scale” so far in the back office.

All that to say, Casper doesn’t look like a very good investment.

Mattresses vs. Sleep

Based on Casper’s S-1 filing, I expect the company will underperform the valuation from its previous round — $1.1 billion in 2019. For comparison’s sake, let’s review the status of Purple, a rival direct-to-consumer mattress company. Last year, Purple posted an estimated revenue of $382 million, a 34% growth rate, and a positive operating income of $8.2 million. Purple already went public (back in February 2018), and their current valuation sits under $600 million.

Time for some questions:

Why would anyone (who has seen the financial comparisons) buy Casper at twice Purple’s price?

Why did private investors value Casper at $1.1 billion?

Why did Casper think the timing was right for an IPO, and why do they believe anyone will respect the value of their offering?

What is the bull case for Casper?

The answer goes back to brand, awareness, and exposure.

On Purple’s website and promotional materials, they describe themselves as creating the best mattress tech advancement in 80 years. In Casper’s S-1 documents, they position their company very differently. Take a look at the way Co-founder and CEO Philip Krim conveys his vision for Casper:

Sleep is the third pillar of wellness alongside fitness and nutrition. People across the globe are increasingly realizing that sleep is central to living happier, healthier, and more productive lives.

No brand had made a commitment to delivering better sleep at scale, through an elevated and aspirational direct-to-consumer experience. Others have memorably created global, trusted brands in fitness and nutrition—while emerging direct-to-consumer brands are disrupting eyewear, personal care and many other categories.

At Casper, our mission is to awaken the potential of a well-rested world. Our ambition is to build the first consumer-centric sleep brand that will endure for generations.

According to Krim, Casper isn’t selling mattresses; they are delivering “sleep at scale.” The reality doesn’t support this vision, at least not yet. Nearly 100% of their revenue to date has come from mattresses and associated products, like sheets and pillows.

Could there be a fortune — or at least $500 million at 50% margins — to be made on TBD sleep products (Casper just released “a light designed to help you fall asleep”).

IF there is a bull case for Casper, it’s based on the size of the potential market for sleep-related products. And if there is a fortune for other sleep products, then Casper is well positioned to take advantage of the opportunity.

Just as the value of Royal Sussex is not in Harry’s military prowess or Meghan’s acting chops, the value of Casper (such that it is) is not the ability to sell mattresses. Casper’s super power is awareness.

Latana, a brand analytics platform, conducted research on the awareness levels of direct-to-consumer mattress brands. (Did you know there are 175 online mattress brands?!) Unaided awareness for all the brands is very low (i.e., if you ask random members of the public to name mattress brands, they will give you blank stares). But in tests for aided awareness — where a survey prompted respondents with the names of brands — awareness levels varied significantly.

According to Latana, here are the aided awareness levels for the leading brands:

Tuft & Needle — 9%

GhostBed — 10%

Saatva — 10%

Nectar — 14%

Leesa — 19%

Casper — 43%

Purple — 48%

Only Purple scored higher than Casper. Going through the IPO process should provide Casper with a slight boost, perhaps enough to claim top spot in aided awareness.

If any company has the “right to win” in gaining consideration from consumers on other sleep products, it is Casper. Is that enough? I doubt it. But still, that is the question I think potential investors should be asking themselves.

Final Thoughts

This “power of awareness” in the general public is underrated. Too many companies shut down old brands because they are no longer deemed relevant. Consultants and advisors forget how hard people worked (and how lucky they got) to push that brand awareness to any reasonable level with the public. For this reason, if you hold a well-recognized brand, you should do everything you can to keep it in the market. And even if you let your brand lapse, you can find effective ways to revive its power.

Case in point: the Hummer is back, but with a new twist. The massive SUV, once described by a Sierra Club official as the embodiment of “the worst impulses of the American auto industry,” is returning as an all-electric model.

Does the switch from gas-guzzling behemoth to tree-saving truck make any sense? Not really, but that doesn’t matter. The Hummer name carries a huge level of awareness, so GM is smart to leverage that power with just about any product.

Will Casper be able to use their brand awareness to drive consideration for other sleep products? I expect they will. Will that be enough to rationalize their valuation? It seems unlikely, but it’s the best asset they have. Anyone can build a comfortable mattress, but you have to be both good AND lucky to build a comfortable brand.

And what about the Duke and Duchess of Sussex. Will they be able to monetize their awareness to earn more than the roughly $3 million (USD) a year they collected as royals? Of that I have no doubt.

Keep it simple,

Edward

If you enjoyed today’s newsletter, I encourage you to click the little heart button below the “Subscribe Now” box. Thanks!

Edward Nevraumont is a Senior Advisor with Warburg Pincus. The former CMO of General Assembly and A Place for Mom, Edward previously worked at Expedia and McKinsey & Company. For more information, including details about his latest book, check out Marketing BS.