Coronavirus and Cohorts

Good morning everyone,

I post these newsletters once a week, but it seems like a year’s worth of events have happened over the last 7 days. Above all else, I wish you and your family the best during this unprecedented situation.

— Edward

Views from Venture Capitalists

By now, most of us appreciate the seriousness of the COVID-19 pandemic. Many venture capitalists, however, sounded the alarm weeks ago. Way back on February 13 (which seems like a lifetime ago now), Vox published an article about tech perspectives on the coronavirus:

One of the most prestigious venture capital firms in Silicon Valley, Andreessen Horowitz, recently put up a sign on its door, cautioning eager startup founders and business partners who walk into its offices: “Due to the Coronavirus, no Handshakes please. Thank you.”

The article goes on to imply that Silicon Valley’s reaction was not only overblown, but unfairly targeted Asians (a partner at Andreessen Horowitz “announced that he won’t be taking in-person meetings with anyone who’s recently traveled to China”).

In the most scathing bit of mockery, the article’s author (Shirin Ghaffary) suggests that some venture capitalists were actually relishing the prospect of a crisis:

In some ways, Silicon Valley elites have been preparing for this moment. Tech billionaires and other wealthy Americans have long been gearing up for Doomsday scenarios like a global pandemic that could disrupt societal stability. Some are building out elaborate refuges as far away as New Zealand.

And yet, here we are.

Less than a month later, the United States has closed its borders to Europe, shut down schools across the country, and postponed sporting events. Even Disneyland locked their doors (for only the fourth time in its history).

What did the VCs See?

(My Twitter photo of a Safeway in Seattle was picked up by BuzzFeed)

When I scroll through my Twitter feed these days, it’s not just the venture capitalists who are pontificating about the coronavirus — it seems like everyone has become an amateur virologist.

Why were (non-medically trained) venture capitalists one of the first groups to express alarm about COVID-19? In contrast to the Vox article, I don’t believe the answer is simply, “because ‘Doomsday elites’ always look for the apocalyptic outcomes.”

Instead, I think VCs instinctively understood the coronavirus concerns because of the way they examine trends. Most people (i.e., non-venture capitalists), process day-to-day information as a linear phenomenon. When I worked at Procter & Gamble two decades ago, my colleagues assumed that next year would be a lot like this year; if we were lucky, we might grow by 2 or 3 percent. Back then, we rarely talked about “growth,” because we focused on “stealing share.” Among our team, there was one prevailing belief: consumers would purchase a finite amount of soap next year, so our job was to capture a bigger piece of the pie.

Venture capital-backed companies don’t think that way.

Instead, VCs evaluate opportunities by analyzing the potential for exponential growth. Think about companies like Airbnb, with a current valuation hovering around $35 billion. Their financial data is private, but sources like the Wall Street Journal have published the following revenue estimates:

2016: $1.6 billion

2017: $2.5 billion (+50% growth)

2018: $3.5 billion (+40% growth)

2019: $4.5 billion (+30% growth)

Billion-dollar revenues are an obvious reason for valuing companies, but VCs recognized the specialness of Airbnb back in 2009 when they only had $850, 000 in revenue. How? Because of the rate at which the company grew. From 2009 ($850K) to 2016 ($1.6B), Airbnb’s revenue almost tripled in size every year for eight consecutive years.

Let’s illustrate the power of exponential growth with a classic parable:

As the story goes, when chess was presented to a great king, the king offered the inventor any reward that he wanted. The inventor asked that a single grain of rice be placed on the first square of the chessboard. Then two grains on the second square, four grains on the third, and so on. Doubling each time. The king, baffled by such a small price for a wonderful game, immediately agreed, and ordered the treasurer to pay the agreed upon sum.

There are 64 squares on a chess board. If you start with a single grain of rice on the first square, and keep doubling, you end up with 2^64 grains of rice on the last square of the board. This sum is a mind-blowingly big number: 18,000,000,000,000,000,000. Measured another way, this figure represents the number of millimeters in one thousand light years. It’s really, really, REALLY big. And it only took 64 doublings to get there.

I think venture capitalists raised red flags earlier than most people because of their familiarity with analyzing exponential growth. COVID-19 had a lot of the characteristics — easy to spread, relatively deadly — that made it a candidate for exponential growth. And once the virus started doing serious damage in Wuhan, it became clear that it COULD expand exponentially. The rapid growth rate was the factor that worried the “Doomsday elite” venture capitalists. Eighteen “billion billion” grains of rice is catastrophic to think about in human terms.

COVID-19 and Cohorts

(My friend — a doctor in the ICU — showed me what her colleagues did to the fridge at work. This was before the crunch started. I suspect humor is in shorter supply now...)

In addition to appreciating the power of exponential growth, successful venture capitals also excel at identifying cohorts, a concept that does not come naturally to most people — not even smart, successful professionals.

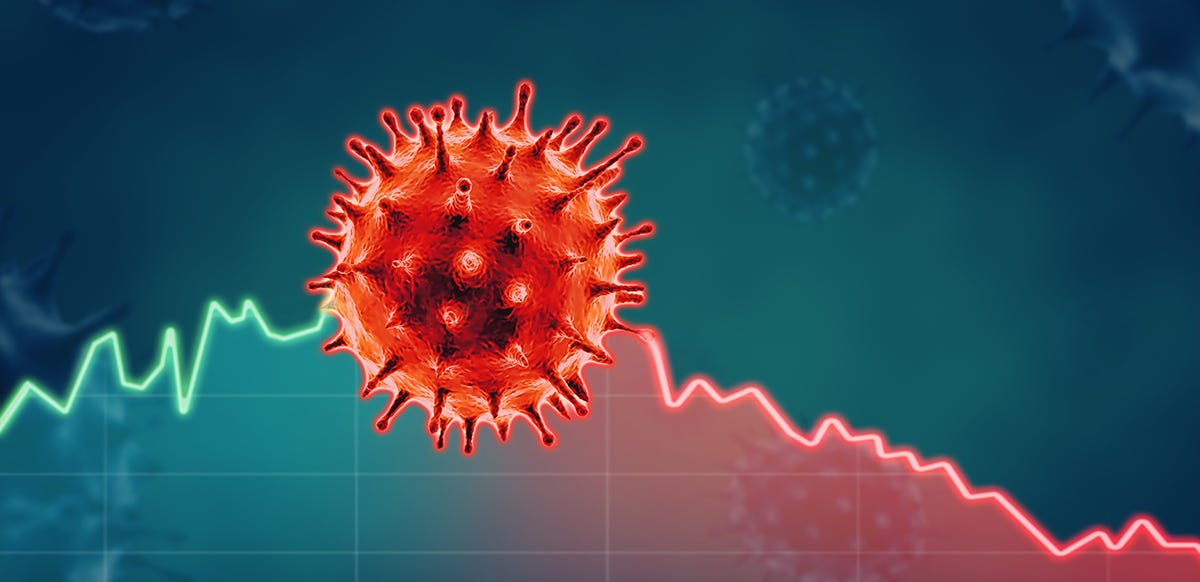

Here is a common format for business reports:

For this hypothetical example, you can see that roughly 10% of the leads collected by the company will turn into opportunities (as defined by the sales people). Moreover, 10% of the opportunities covert to a sale.

What conclusions can you draw from the table? February looks like a bad month for leads (20% drop month-over-month!), but the opportunities only dropped by 10% and the sales figure seems strong. So which assessment was correct — was February terrible or great? A typical manager might say “the month was bad for leads, but great for sales.” But that characterization just prompts more questions: “Why? Don’t leads convert to sales at roughly 1%? Does that mean we just did a great job converting leads to sales that month?”

Not necessarily. And not likely.

You need TIME to convert a lead to a sale. In some industries, it’s not uncommon for 30 days to pass before converting a lead into an opportunity; turning that opportunity into a sale can sometimes take months. During my time at A Place for Mom, 10% of our sales came from leads more than 12 months old. 2% of our sales came from leads more than 24 months old!

A good sales month might be the result of an awesome cohort of leads — from four months ago.

How would you know?

The solution: look at the sales process through the lens of COHORTS rather than ACTIVITIES.

Here is a different approach to creating a business report to track sales:

Now we can see both the quantity of leads that arrive in a given month AND the quality of those leads. In this case, the January leads might have been “ordinary” quality; after 150 days, 10% have converted into opportunities. February leads, while fewer in number, yielded a higher percentage of opportunities. Even after 30 days you can see the difference between February and January leads, and by the time the leads have had 150 days to “bake,” the February ones are converting 30% better than the January ones. Meanwhile, the March leads look terrible. They did a little worse than average for the first 30 days, but after 150 days, only 6% converted to opportunities (40% lower than the average).

By looking at the business in the context of cohorts, you gain more insight. But you also open up more questions. Why did March leads look okay for 30 days before falling apart? Were the leads just low quality, or did the sales team do something wrong — maybe drop the ball on the follow-up calls. Think about the difference between January and February. Did February leads come from a difference source? Would there be a way to collect leads with January's volume and February's quality?

Once you start thinking in cohorts, it is uncomfortable to even look at the data with an activity view.

Growing Businesses

Activity views are the default reporting method for most businesses because they are “good enough.” For business with relatively consistent sales, an activity view can provide a simple way to scan for major differences from month to month.

Cohort views become essential for companies with fluctuating sales — particularly if it is growing fast. If March has twice as many leads as February, then any ratio calculations from activity view tables will badly misstate your business results. Using the same PERCENTAGE conversions from the previous table, I am going to plug in vastly different lead numbers:

Here is what that same information looks like from an activity view:

Recall that March leads were TERRIBLE, but with an activity view like this, the March leads look better than the January ones.

The faster a company grows, the worse activity view tables perform. The problems of activity view tables are particularly bad when the rate of growth changes from month to month (e.g., a business grows at 2% one month and then 80% the next).

Virus Cohorts

Let’s connect the concept of cohorts back to what is happening with COVID-19.

As I write this (March 14), there are 2900 confirmed cases of the coronavirus in the United States, along with 59 deaths.This information represents the activity view. Those figures tell us what we know RIGHT NOW. Just like you could calculate the conversion rate from lead to opportunity in our business example, you could calculate the death rate for the COVID-19 — just take 59/2900 = 2.0%.

The optimist looks at that mortality number and understand how it might be overstated:

The US has failed to set up effective testing procedures, which means the total number of cases both vastly understated and misrepresented.

We know that many people will get the disease without getting very sick or needing to go to the hospital.

As such, tested cases will disproportionately come from people are most negatively impacted by the virus.

If the virus does not make you very sick, then you will not be counted as a case at all — and by definition you aren’t going to die from it.

Bottom line: we are only counting the “worse” cases. And that death rate is “only” 2%.

But the pessimist — and the venture capitalist — remembers to think about exponential growth and cohorts.

The number of infected people in “normal” conditions can grow very fast.

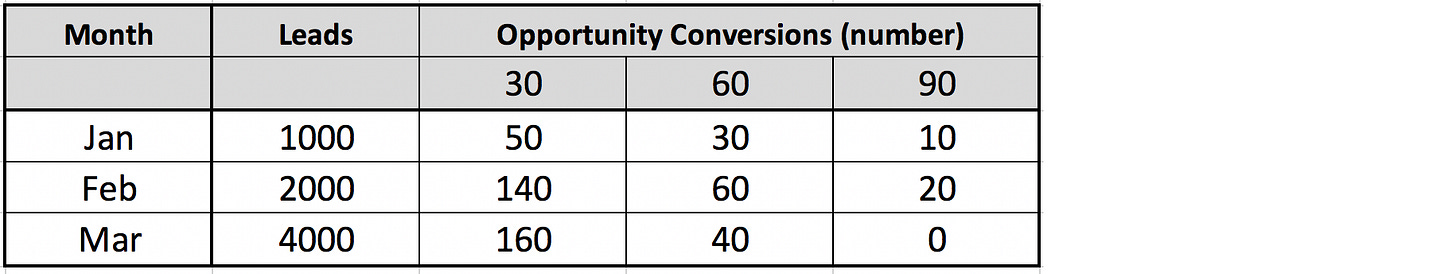

Here is a chart (using Tomas Pueyo’s analysis) illustrating the number of infections in Hubei, China, including both “date of onset” and “date of diagnosis.”

The blue lines on the chart show the number of NEW infections on a specific day. On January 16, there were ~500 new infections. If you total all the infections from every day BEFORE January 16, you get about another 500, for a total of 1000.

And then it exploded.

New infections per day (approximate)

Jan 17 — 600

Jan 18 — 600

Jan 19 — 900

Jan 20 — 1400

Jan 21 — 1500

Jan 22 — 2000

Jan 23 — 2500

If we take the 1000 from January 16 and add the next 7 days, we get a total infected number of 10,500. Simply put, the number of infected individuals jumped by 10x in a single week (~1000 to ~10,500). [Note: even after the lockdown started, it took over a week before the daily number of new infections started to decrease].

If it takes three weeks from infection with the virus to die, and infections are growing at even 5x/week, then the math gets very scary, very quickly. Just like the grains of rice on the chessboard, 2900 cases in the US today means only twenty-three cases three weeks ago (23 x 5 x 5 x 5 = 2,875). And the current total of 59 deaths from 23 infections results in a mortality rate of more than 100% (which obviously means we are undercounting infections, overstating the growth rate, or overestimating the time between infection and death — maybe all three).

The point is not that the mortality rate is much higher than 2%. The point is that we can’t determine the mortalityrate unless we look at the data from a cohort view instead of an activity view.

To build a cohort view, we need a much better method of identifying when someone becomes infected (something South Korea is doing much better than America and Europe). But collecting that data is still not enough. Many analysts have noted the fact that the death rate in South Korea (0.9%) is much lower than Italy (6.8%) (as of March 14), but those number comparisons provide an activity view. Clearly, South Korea’s mortality rate is lower than Italy, but without knowing the “2-week survival rate,” comparing these countries to each other (or to themselves over time) involves a lot of tense speculating.

Final thoughts

The other day I told my 5-year-old there were four major events to happen in my lifetime: the fall of the Soviet Union, 9/11, the 2008 financial crisis, and now COVID-19. It is entirely possible that this pandemic will be the most impactful of the four.

I am (obviously) not a virologist, but I am comfortable analyzing exponential growth and identifying cohorts. Based on the hours I have spent every day for over a month trying to understand what is likely to happen in the world — especially the actions I should take for my friends and family — here is my best advice:

1- Understand that when something is growing exponentially, it might look really small, but it can become giant very, very fast. Growth percentage per time period is the most important metric to consider.

2- When looking at rates (especially in fast growing environments), always consider the cohort view. Don’t divide deaths by infections today — you need to divide deaths by the number of infections from 2-3 weeks ago.

Given how fast the situation is developing, the information in this newsletter may be obsolete hours after it is published, but those two concepts will always be important — even years from now when COVID is a memory.

In the meantime, stay safe. And please — be prepared for things to get a lot worse than they are today.

Keep it simple,

EdwardIf you enjoyed today’s newsletter, I encourage you to click the little heart button below the “Subscribe Now” box. Thanks!

Edward Nevraumont is a Senior Advisor with Warburg Pincus. The former CMO of General Assembly and A Place for Mom, Edward previously worked at Expedia and McKinsey & Company. For more information, including details about his latest book, check out Marketing BS.