Welcome back from Labor Day. This is the free Marketing BS issue this week. Premium subscribers get a second issue every week. The premium issue tends to be a little more technical, and/or a little more controversial. If you like those things you should subscribe!

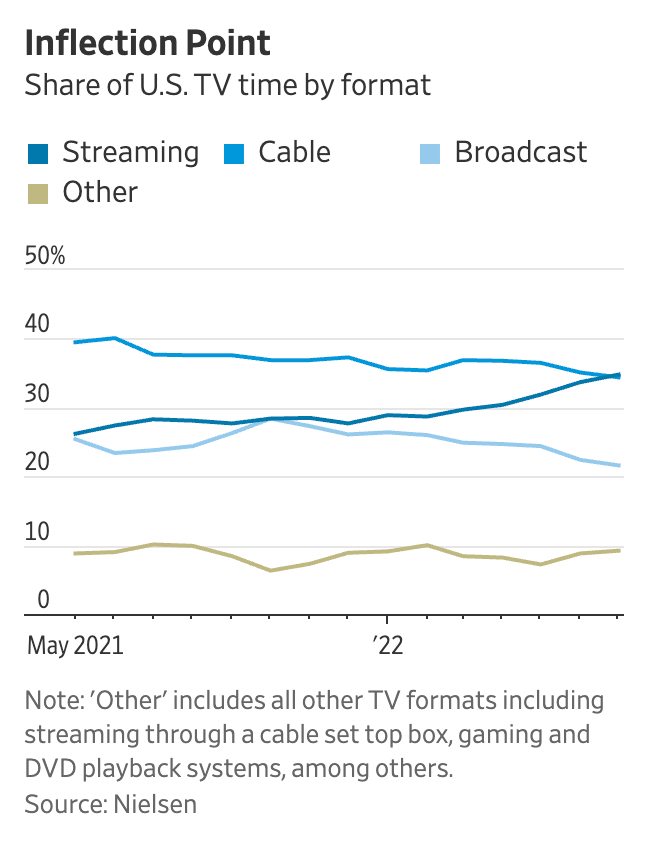

People thought traditional television advertising was dead long before it actually started dying (mostly because the pundits themselves had stopped watching advertising-supported TV. Their customers were still watching). But they were right that traditional ad-supported TV was on a long and slow decline. In August streaming finally surpassed cable in time spent among all Americans (but note: hours spent watching Cable + Broadcast is still significantly above streaming). Here is what the trend line looks like (from the WSJ):

Traditional TV is not dead yet, but it is clearly dying. When the major media companies all decided simultaneously that they were jealous of Netflix’s valuation and all launched streaming services with all their best content, they accelerated the decline of the traditional bundle. Traditional TV was going to die eventually, but the beneficiaries of traditional TV made sure it happened faster than it needed to.

The result is that right now the only reasons to subscribe to traditional TV is live sports and “momentum” (but don’t knock momentum. Just as there are people who still get a newspaper delivered every morning, there will be people who pay to access NBC until they die).

For marketers the biggest challenge that comes with the death of TV is, “where do we advertise?”. There are lots of advertising channels, but nothing historically has had the impact, fidelity and reach of traditional TV ads. I asked the question in this newsletter a few years ago and my best answer at the time was something like advertising on podcasts and before feature films. Podcasting was growing. Audio ads do not have the impact of video ads, but in theory there could be significant reach. Feature films would not give you as much reach, but had very high fidelity. I was not satisfied with either answer, but it was the best I had at the time.

What I did not see coming was the rapid growth of ad-supported streaming. In hindsight it made sense. Many people will be happy to get a discount on their media consumption in exchange for time viewing ads (as much as they say they don’t want it, in practice most people are willing to make the trade-off). The added benefit is that Connected TV (CTV) ads have the advantage of much better targeting and tracking. It is a lot easier to know if they are working (vs traditional TV ad spend).

Ad supported streaming is still a very small percentage of the streaming market (which, as we saw above is still only ~35% of the viewing time). FAST (Free Ad-supported Streaming) is ~11% of the market. Netflix’s ad supported tier is 11% of their subscribers. Disney+ is ~19%. There is still a long way to go to make the channel significant and scalable. But both companies have made it clear that growing ad-supported is their goal. Netflix has said that ARPU is higher on the ad supported plan than on their basic plan (and they have cancelled the basic plan going forward). Disney has raised prices significantly on the “no ads” product and signaled they will raise it more. Ben Thompson at Stratechery has argued that Netflix should reduce the price of the ad-supported plan to “free”.

It is becoming very clear that the replacement for ad-supported television via cable is ad-supported television via streaming.

NBC turns into Netflix and ABC turns into Disney+. History rhymes.

Mostly things will end up being just about the same as they have been for the last six decades.

But there is one player that is very well positioned for the change: Amazon.

The Economist writes “Amazon has Hollywood’s worst shows but its best business model”. Adding video to the Prime bundle always seemed like a stretch. In theory people could sign up to see Transparent, but then get addicted to the fast-free shipping, or they could sign up for free shipping and stay to watch the Lord of the Rings. The whole idea of a bundle is combining two things that are semi-related. But were these two things related at all, even in a semi-way? Did the incremental Prime memberships come close to paying for the huge media outlays ($1B for Lord of the Rings; $8.5B for MGM)?

But ad-supported changes everything. Amazon’s share of total digital ad spend is growing and approaching Meta:

Good digital ads are a combination of two things:

Good targeting

Good ad units

Google and Meta have both of those things. Amazon has excellent targeting (the most important data for targeting ads is knowing what your target has purchased), and, if you are selling on Amazon, excellent ad units. But if you are NOT selling on Amazon then their ad units are very weak: Display ads on IMDB, cover takeovers on Fire Tablets, Amazon music, etc. (More on their ad options here).

But the best ad unit of them all is a 30-second un-skippable video TV spot.

If Amazon is able to build a large media business with a significant ad inventory, and then combine it with the existing targeting capabilities based on logged in users with multi-year purchase histories, then they will have a very killer product offering. If you are not already, I suggest it may be time to test out advertising on Amazon’s network right now. Even if you are not selling on Amazon, you may be able to get the ad units to work given it’s targeting capabilities. With the added bonus that when Amazon rolls out TV ads you will be ready.

Keep it simple,

Edward