Why are Customer Acquisition Costs Going Up?

Welcome to Marketing BS, where I share a weekly article dismantling a little piece of the Marketing-Industrial Complex — and sometimes I offer simple ideas that actually work.

If you enjoy this article, I invite you to subscribe to Marketing BS — the weekly newsletters feature bonus content, including follow-ups from the previous week, commentary on topical marketing news, and information about unlisted career opportunities.

Thanks for reading and keep it simple,

Edward Nevraumont

Why are customer acquisition costs going up?

In my June 18 newsletter about The State of the Internet, I reviewed Mary Meeker’s 2019 report on the digital world. Meeker’s presentations always contain an astonishing number of observations, so I highlighted five key takeaway ideas, including this one on rising customer acquisition costs:

As advertisers shift to digital channels faster than users’ time spent online is growing, we are witnessing the real-time effect of supply and demand curves. Although Meeker’s only slide on customer acquisition costs specifically examines FinTech companies, I expect the pattern will occur almost everywhere: online customer acquisition costs (CAC) are up roughly +20% in the last two years. I’m seeing this phenomenon with my clients who — two years ago — worked hard to optimize Facebook and enjoyed a great marketing channel; today, they are now struggling to make the economics work. It’s not that these companies got worse at marketing, it’s that the crowd has joined them, making the channel more efficient.

Today, I want to expand on that paragraph and dive deeply into the details of customer acquisition costs. My analysis will exclusively look at the United States, because (1) that’s where many companies focus their customer acquisition, and (2) we can easily collect and access the relevant data.

When we hear that customer acquisition costs are increasing, most of us have the same initial reaction: “of course they are.” I mean, why wouldn’t they be increasing? More and more companies are trying to buy a limited amount of ad space; thus, the prices keep escalating.

Although that simple explanation seems like a satisfactory answer, it actually begs a few more questions:

WHY is there an increase in the number of companies trying to buy ad space?

WHY isn’t there more ad space to meet that demand?

If prices are rising, WHY NOT shift spending to other advertising channels (like print or television)?

I want to start with the second question, return to the first, and end with the third.

Why isn’t there more ad space on the internet?

To understand why customer acquisition costs are rising, we need to understand what is happening with advertising supply.

Advertising supply on the internet is based on three factors:

amount of time people spend on the internet

“ad load” — the relative volume of advertising versus content on websites

ad effectiveness — the percentage of people who view an ad AND are influenced to buy the product

Let’s examine all three factors.

Amount of time people spend on the internet

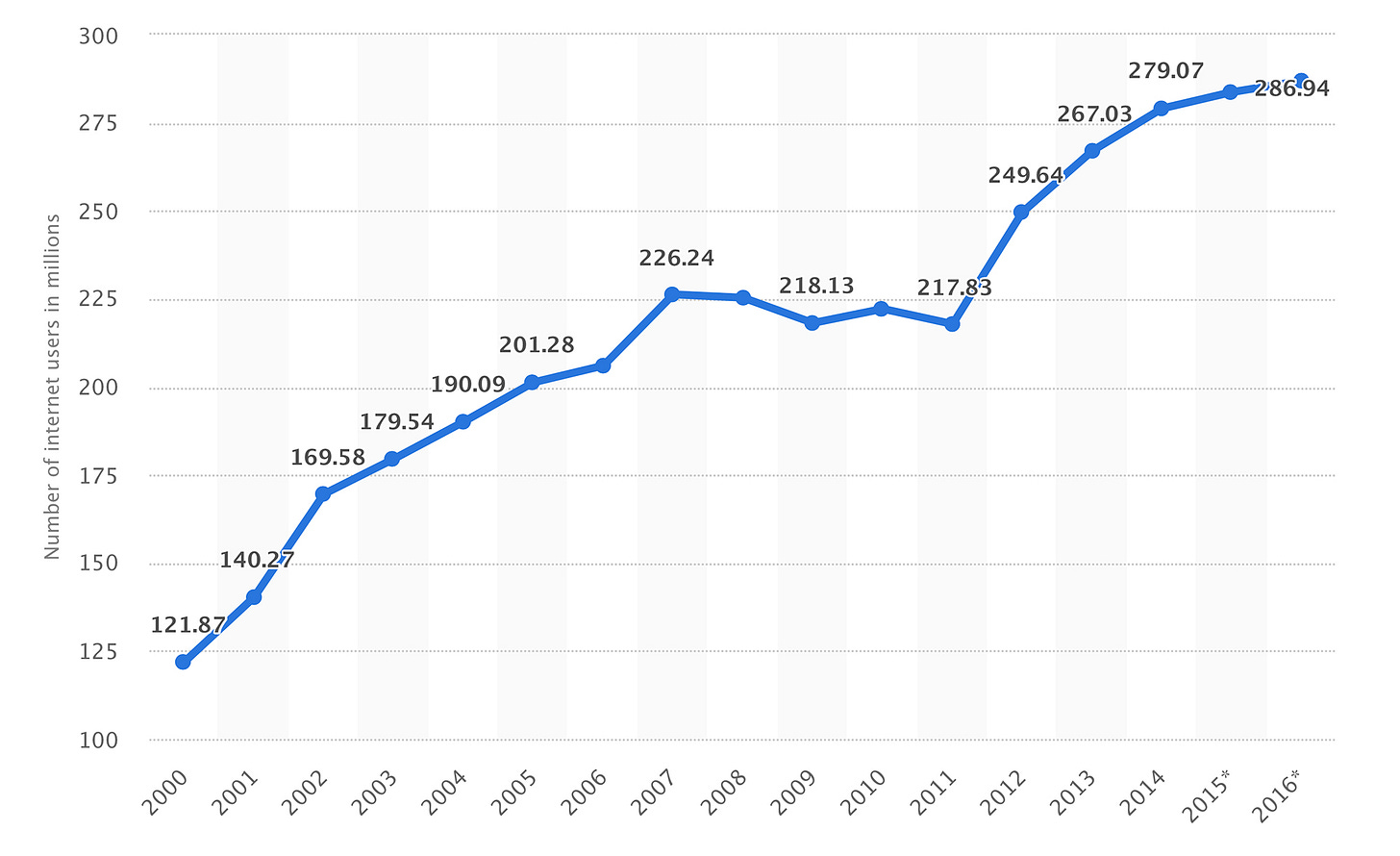

Research portal Statista created a chart to illustrate the number of internet users in the United States from 2000 to 2016:

Unless you live in a cave, you don’t need a chart to tell you that internet usage in America soared over the first sixteen years of this millennium. The recession caused a leveling off from 2007 to 2012, but usage picked up steam again — largely due to mobile devices. Around 2014, the number of users has essentially flatlined.

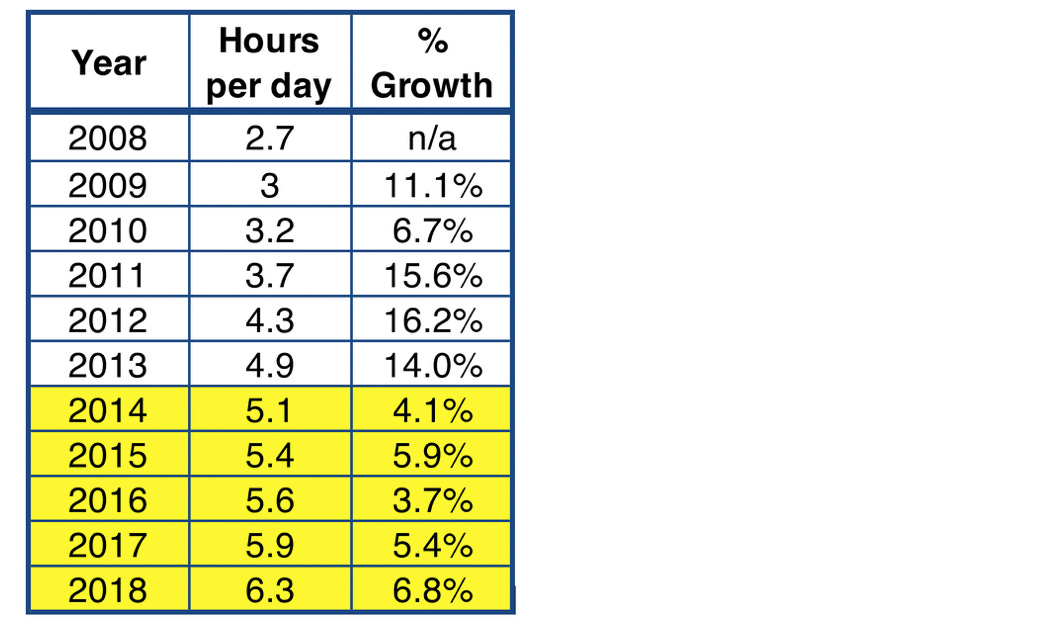

To determine the total time spent on the internet, we need to multiply the number of users (shown above) by minutes spent per day per user, which we can learn from one of the slides in Mary Meeker’s 2019 report on the digital world:

One conclusion is readily apparent: daily time spent on the internet — per user — has continued to increase. That said, just as growth in the NUMBER of users started slowing down in 2014, so too did the increases in DAILY TIME per user.

Based on the information from the above chart, I created a simple table that highlights the growth trajectory of daily hours spent online:

In this format, you can easily spot the trend: from 2010 to 2013, daily time per user increased approximately 15% a year, after which point its growth slowed to ~5% a year.

To really put this digital era into context, let’s look at the TOTAL hours spent online, by multiplying the daily time per user by the number of American internet users. From 2014 to 2016 (the last year of the Statista chart), the total number of hours spent online increased by ~6%.

In the big picture, 6% annual growth as a baseline for a business is nothing to sneeze at. Still, it’s a dramatic shift from the explosive growth of total hours spent online from just a few years earlier — 22% in 2013 and 33% in 2012!

The bottom line for advertisers? The potential audience for online ads is still growing, albeit slowly.

Ad Load

For advertising channels with a physical presence, identifying the “supply” of ad space only requires some simple counting: “how many pages are in the magazine?” or “how many billboards are in the city?” Determining the supply of ad space on the internet, however, requires a few calculations. Market researchers analyze the number of hours people spend on the internet and the number of ads they encounter in that time. The resulting metric — ads seen per unit of time — is referred to as “ad load.”

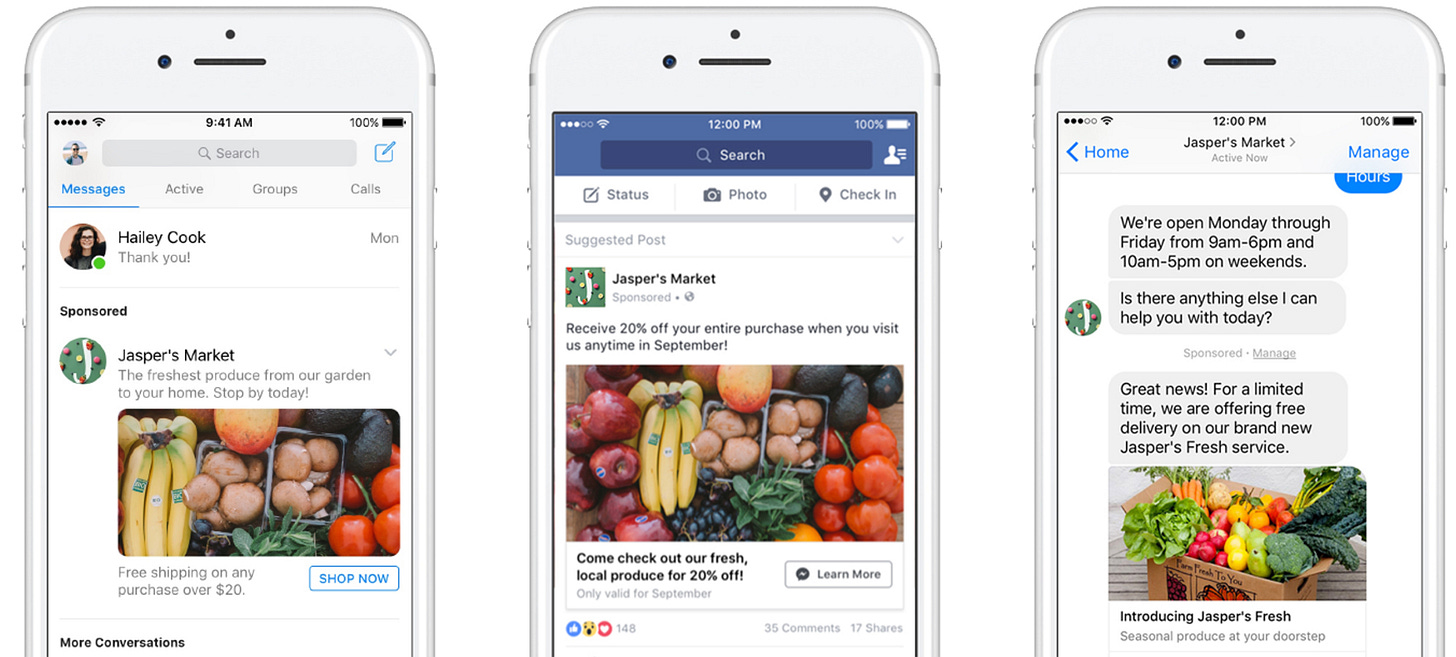

To understand recent trends in ad load, I am going to zoom in on Facebook, where — not surprisingly — a significant portion of actual customer acquisition takes place.

This summary of Facebook’s disclosures from Bloomberg illustrates the trajectories of both ad numbers and ad prices (from Q1 2016 to Q3 2017):

In 2016 — when the growth of internet users and online time was slowing down — Facebook still managed to increase their number of ads by 50%. By the start of 2017, though, the company began to hit a wall on ad density in their newsfeed.

What happened next?

Quite simply, ad growth could not keep pace with ad demand, so prices for the ads started rising. In 2016, year-over-year increases in ad cost were less than 10% a year.

By Q3 2017, ad prices leapt by more than 30% from Q3 2016.

Facebook faces a tricky predicament. Their revenue formula is straightforward:

user time x ad load x CPM (the cost per thousand advertisement impressions on a webpage)

Their advertising product has “zero marginal costs,” so the company is (relatively) ambivalent between two ads appearing for $10 each or a single ad appearing for $20 — either way, Facebook earns $20. Of course, there is a limit to how much money advertisers will pay. To bolster revenue, therefore, Facebook needs to push ad load as high as possible. But…when increasing ad load, they need to avoid the tipping point that would impact the user experience so negatively that people spend less time on their platform!

Facebook has invested substantial effort into developing its ad load, but since 2017, they have yet to achieve meaningful growth for their “Feed,” the central feature of the platform’s user experience. During Facebook’s earnings call on January 30 of this year, CFO David Wehner provided specific details of their strategy:

And while we have opportunities to grow impressions on Facebook and Instagram, that's less so in Feed, where we already have healthy ad loads on both surfaces, and more in Stories,where we have lower CPMs. So, whereas in 2018, we benefited from strong impression growth on Instagram in both Feed and Stories, we'll be more reliant on Stories impression growth in 2019. [Emphasis mine]

A few corners of Facebook’s empire still offer opportunities for better ad load optimization: the “Stories” feature for both Facebook and Instagram (user-created photo/video collections), as well as Instagram Explore (an algorithm-generated stream of new content to discover). My prediction? Facebook will find a way to boost the ad load on these features, BUT...they will face an uphill battle, struggling to increase ad load faster than the growth in ad purchase demand.

Remember, advertising supply on the internet is based on three factors. Both (1) amount of user time spent online, and (2) ad load are still growing, but at minimal trajectories. That leaves (3) ad effectiveness. In theory, improving the quality of ads (in terms of impacting consumer behavior) could compensate for shrinking ad inventory, leading to lower CACs.

So, what’s happening in PRACTICE? Let’s take a look.

Ad Effectiveness

As you can imagine, “ad effectiveness” is a somewhat abstract concept that resists quantitative analysis. As such, we need to reflect on what we’ve observed from personal experience — namely, that companies SEEM to be getting savvier with their digital ad strategies. During my time at General Assembly, for instance, I watched L’Oréal transform from an old-school consumer packaged goods firm to a company that started thinking “digital first.”

How might we explain improvements in ad effectiveness?

First of all, large advertisers are recognizing the value of marketing firms with expertise in innovative online strategies. With a “digital first” team, you would expect ad buyers to demonstrate greater proficiency in conception and execution of online campaigns. In turn, as effectiveness increases, the “cost per impression” could go up without (significantly) impacting the cost for an acquisition.

A second increase in ad effectiveness stems from a shift in consumer behavior. As companies enhanced the usability of their websites and apps, customers responded with a greater willingness to make purchases on their mobile devices. During my time at A Place for Mom (2015 — not that long ago), our conversion rate from mobile traffic was DRAMATICALLY lower than from desktop activity. Because of that lower conversion rate, we would “bid down” to pay less per click for those mobile (lower converting) clicks. We weren’t the only one. Google noticed this trend and, to keep their mobile auction robust, only served one ad on mobile searches. Today, many of my clients see a HIGHER conversion rate on mobile; moreover, Google definitely serves more than one ad on iPhone and Android searches. Without question, ad effectiveness on mobile is considerably better than only a few years ago — which is fortunate, given that all of the recent growth on “screentime per user” has come from mobile devices.

Should we expect the quality of ad effectiveness on mobile to continue improving with such dynamism? Probably not, barring a sudden technological breakthrough. In fact, I wouldn’t be surprised if the advancement of ad effectiveness has already started slowing down over the last 12–24 months.

To recap, then, we are faced with four realities:

no increase in the number of online users

modest increase in time per user

limited opportunity to increase ad load

limited expectations of improved ad effectiveness

The end result? A very, very small increase in the supply of online ads.

This might not pose a problem, IF the demand for ads remained static. Alas, that’s clearly not the case — the cost for Facebook ads have been headed to the moon since 2017.

All of this brings us back to our first big question about the rise of customer acquisition costs…

Why are there more companies buying ads on the internet even as those ads are increasing in price?

The easy answer would be, “because more companies are discovering that advertising on the internet works.”

But that seems like a gross oversimplification, especially because it overlooks a more important point — advertising on the internet requires less EFFORT than ever before.

To elaborate on this idea, let’s contrast Reddit and Facebook.

Why Reddit doesn’t Monetize

If you’re unfamiliar with Reddit, it’s a website that describes itself as “the front page of the internet.” With forums (called subreddits) for just about any topic imaginable, people not only share news and other content, but also write comments (frequently!) on other people’s posts.

Just how popular is Reddit? As of July 2019, Reddit is the 6th most visited website in the US, according to Alexa Internet.

Let that sink in. The sixth most visited site — right behind Google, YouTube, Facebook, Amazon, and Yahoo. And yet, I still felt a need to provide context for readers who might be “unfamiliar” with Reddit. The company holds a quasi-monopoly on message boards in the United States, but when Congress discusses antitrust regulations, you never hear anyone mention Reddit. Why not?

No one seems to care because Reddit does not generate much revenue. CNET predicts Reddit will surpass $100 million in revenue by the end of 2019. But then again, CNBC thought that 2018 would be the year Reddit crossed the $100 million threshold (it didn’t). Suppose Reddit does hit $100 million in revenue this year, there are some lingering questions: why not higher and why not sooner?

Compared to Reddit, Twitter has (1) fewer users and (2) less time on site per user. Nevertheless, Twitter’s 2018 revenue reached$760 million per QUARTER(not year) AND was growing revenue at 29% year-over-year. Twitter has been growing its QUARTERLY revenue by 50% more than Reddit’s TOTAL ANNUAL revenue. And remember — compared to Facebook, Twitter is not very good at monetizing its users.

Why doesn’t Reddit make any money?

You might assume that Reddit ads are not effective. In my experience, though, I always achieved higher ROI on Reddit ads than ones on Twitter.

The real reason that very few companies advertise on Reddit?

It’s too hard to advertise on Reddit:

Profiles on Reddit (unlike Facebook) are anonymous. Reddit has not provided any tools to target audiences apart from choosing a subreddit. You can’t even target by gender or geography.

You need to find the precise subreddit to place your ad, which requires manual effort, limiting the ability to scale.

Once you find a suitable subreddit, there is no way to follow its subscribers when they visit different subreddits.

As such, hitting a high ROI marketing campaigns requires that you (1) identify the best subreddits for your product, (2) find the ideal landing pages (for that specific subreddit), and (3) build the perfect ad copy (once again, for that specific subreddit).

Even then, your results will be small. REALLY small. I have never seen a business with even 1% of their customer acquisition value coming from Reddit ads. So, you need to ask yourself, “how much effort do you want to put in for a profitable, but tiny, marketing channel?”

Facebook is the opposite of Reddit

Facebook is the opposite of Reddit. Facebook offers enormous possibilities for scale. Some companies — to their chagrin — rely almost exclusively on Facebook for all of their business. I can’t imagine even a single company that relies on Reddit for all of their business (at least as a paid channel). If your company has not yet figured out how to advertise on Facebook, you should invest the time to try — even just to prove that it won’t be the right fit for you. Quite simply, Facebook is too BIG a channel to ignore. (Notice that I didn’t need to provide context for readers who might be “unfamiliar” with Facebook…).

Advertising on Reddit, on the other hand, is a nice indulgence once your business has optimized everything else and is looking for another challenge to get +0.3% growth.

The hidden variable of customer acquisition costs

Generally speaking, good customer acquisition math looks like this:

Marketing costs < Revenue – (sales, operations, goods) costs

If you can spend $1 on marketing and generate > $1 in “marginal profit,” then you should do it, right?

Not always. Think about the hassles with advertising on Reddit. If you consider those issues, then the ACTUAL customer acquisition equation should look something like this:

Marketing costs + EFFORT < Revenue – (sales, operations, goods) costs

Figuring out Reddit takes a lot of work. That work is a cost in either real dollars or at least opportunity cost (of say, spending more time optimizing Facebook ads). Effort is the overlooked barrier that plagues Reddit, and — expanding that idea more generally — effort is the hidden variable that explains why CACs are going up.

The internet is getting easier

Let’s think about effort in practical terms. Back in 2011, I was running a start-up and EVERYTHING seemed like a challenge. We had to pay a very expensive developer to build our landing pages. We engaged costly vendors to manage our servers, just to make sure we were ready for estimated levels of traffic. I remember spending an entire week selecting a provider for our online payment system. For even a seemingly easy project like our Wordpress blog, I spent multiple weekends learning how to code the pages myself, just to avoid paying a pricy designer.

Today, completing all of those tasks would be a simple process. Landing pages could be run by Optimizely or Unbounce. We wouldn’t even think of managing servers (instead, we’d be choosing which cloud providers to use). Square could take care of payments. Creating a stylish blog, with a straightforward drag-and-drop interface, could be quickly accomplished on Wix or Squarespace. Let’s not fool ourselves — building a business is still a lot of work. That said, I could have launched my start-up with A LOT LESS work today than even a few years ago, freeing up my energies for other parts of the business.

In addition to simplifying the process of kick-starting a new business, these emerging digital tools have provided fantastic shortcuts for existing companies that want to develop an online presence. Using Shopify as a base, just about any retailer can build an internet storefront. Providers exist to outsource logistic processes of manufacturing, storage, and shipping, as well as creative tasks like branding and graphic design. In many ways, it’s never been easier to build and grow and expand a business.

Let’s connect this idea to my earlier point that effort is the hidden variable responsible for recent surges in CACs.

The following equation exists in a state of equilibrium:

Marketing costs < Gross Profit

If gross profit were to increase due to an external shock (like the reduced tax rates we saw last year), that should motivate companies to boost their marketing spend. Why? Because they are now more profitable for every customer acquired; plus, they can profitably spend more to acquire a customer.

What happens when we add effort to the equation?

Marketing costs + EFFORT < Gross Profit

In this case, there's an additional factor that can cause marketing costs to swing up or down. If effort decreases AND gross profit stays the same, then there’s a likely outcome — companies will increase their marketing spend. And that’s exactly what has happened over the last few years.

There’s an old saying that during a boom, forget about digging for gold and start selling shovels. During this internet boom, the shovel sellers have capitalized on the opportunity and earned some impressive profits for themselves. More germane to our discussion today, they have also started selling some amazing shovels that just keep getting better — encouraging more and more people to go digging for gold.

All of this leads us to our third and final question about the rise of customer acquisition costs…

Why not switch to new channels?

Even if the WILLINGNESS to pay for advertising has gone up, that doesn’t explain why the COST of advertising has gone up.

Any first year economics student can tell you what happens when there is more demand for a product in a competitive environment — prices will go up in the short term. Then, in the medium term, new suppliers will enter the market and drive prices back down, until the point where unit price equals marginal unit cost.

But that only works if there is more supply to provide.

In a future newsletter, I will investigate the challenges of switching to new channels. For now, though, we can observe what happens with offline marketing costs when the online costs are being driven up. And it’s confronting an industry we all know something about — television. A June 20 article from Variety provides details:

Advertisers have moved to lock down broadcast inventory in this year’s upfront, conscious that rapid viewership declines fueled by moves to digital video mean they actually have to worry about a diminished supply of consumer eyeballs. That has created higher demand for TV time, and pushed up the rates networks are seeking.

CBS pressed for big increases in the rates it costs to reach 1,000 viewers, a measure known as a CPM that is central to these annual sales discussions. CBS sought primetime CPM hikes of between 14% and 16%, this person said, compared to the 9% to 10% it sought in 2018’s market. [Emphasis mine]

There are less people watching television, but demand for TV spots is increasing. As a result, advertisers are facing CPM increases of 10% this past year and 15% next year. Not so different from what is happening online.

Final Thoughts

If marketers want to pay lower CACs, they will either need to (1) find new marketing channels where demand is not high AND increasing, or (2) hope for a recession to decrease demand from other advertisers. More on new channels in coming weeks. You’ll have to find a different newsletter if you want help in predicting recessions.

Keep it Simple,

Edward

If you enjoyed this post, I encourage you to click the little heart icon below my bio. Thanks!

Edward Nevraumont is a Senior Advisor with Warburg Pincus. The former CMO of General Assembly and A Place for Mom, Edward previously worked at Expedia and McKinsey & Company. For more information, including details about his latest book, check out Marketing BS.