Marketing BS Links 8/11/20 - Bill Gates, TikTok, and Bend it Like Beckham

The stuff you need to know as a Third Way CMO from the past week

This is the new weekly links email which will be delivered every Tuesday morning. The weekly essay has been moved to Monday mornings (You should have received it yesterday).

Follow-up: In case you missed it yesterday’s post was (I thought) clearly meant as satire. Many of you missed last week’s essay due to “threading”. It covered the important idea of how individual incentives often trump company incentives - read it here.

Changes: I have added career opportunities to this email (moved from the essay). I have expanded on the Marketing/Advertising content as requested from some of your feedback (other feedback? Please reply to this message).

Coming soon: Marketing BS Podcasts

If you read one thing this week: Bill Gates interview with Steven Levy at Wired is phenomenal and covers so much ground it is impossible to adequately summarize.

News:

TikTok: Biggest tech news of the week. Much to unpack.

Microsoft's TikTok purchase now, if it happens at all, will likely be global - not just for the US, Canada, Australia and New Zealand as originally reported. This makes sense. Trying to branch off the code for specific geographies would have been difficult, and given the product pulls the most engaging content from EVERYWHERE, the more content available, the more engagement. Breaking it into regions with walls between them significantly decreases the value created. The whole point of the sale should be to take the algorithm out of Chinese hands, so pulling content from outside the region of control would have caused more issues. If it was regionalized, the natural next step would be for Microsoft to expand outside the US, which ByteDance would want prevented in the contract, which would then get into issues around definitions (What happens when someone from the US has a UK phone? Or travels to the UK?). It makes far more sense to have it all sit with one owner - otherwise value is being destroyed.

Twitter is now also in the running for what looks something likes a reverse take-over. Still seems like a long shot, but ByteDance needs to have some sort of leverage or Microsoft will walk all over them. If this happens I expect the new management team will come from TikTok, not Twitter (which shows just how poorly run Twitter has been - see “Vine”) (WSJ$)

What the executive order actually bans: They are calling it “Clean network” and it’s not just TikTok. Huawei, Alibaba, Baidu, and Tencent are all specifically called out. This could stop use of WeChat to communicate between the US and China (affecting those with family living overseas). It’s going to get ugly.

Eugene Wei has an excellent essay on what makes TikTok special (tldr: It’s the algorithm)

Facebook: Meanwhile Instagram has launched their TikTok copy-cat. This was obviously well in progress long before the ban. The goal here is not to beat TikTok directly or steal users back, it is to hold onto existing Instagram users - give them a reason not to leave to begin with. This is the same playbook as Instagram Stories wrt Snapchat. Here is a chart of Facebook copycats. Here is some commentary on how this makes Instagram even more complicated as an app (She’s right!)

Google: Is now allowing lead collection “in-ad”. Facebook did this years ago. It usually gave a jump in leads, but also a drop in lead quality, such that it was a marginal impact on ROI. But worth testing.

Coca-Cola: Last week it was alcohol. Now Coke has announced a release date for their next brand extension - Coca-cola coffee.

Quibi: Is testing a free ad-supported version in Australia and New Zealand. With TV viewership dropping there WILL be some sort of video-driven ad product that gets traction. Essay coming on this in the next few weeks. (WSJ$)

Facebook: Just bought 2.2MM square feet of office space in NYC. The future is still uncertain. (NYTs)

Disney: Will release Mulan as a rental on Dinsey+. Two-tier bundles make a ton of sense (Pay $7/month to get D+, then pay $30 for new movies). If you “rent” Mulan you get to keep it as long as you are subscribed to Disney+ (No late fees :) ) which should reduce churn of the primary product. Disney said this is a one-off and they will be back in theaters when its possible (including for Black Widow and The New Mutants), but you know that will change on a dime if this experiment results in interesting economics. (WSJ$)

Google: Fitbit acquisition may be stopped by European regulators over data concerns. Even the regulators have been hoodwinked into believing everything is about data. Data is really just not that valuable and that is not the point of this acquisition….

Twitter: Ten months ago Twitter admitted to using security-based data (phone number, email address) for ad targeting purposes. Now it looks like the FTC may fine them $150MM-$250MM. This is entirely a government vs company event. Consumers really really don't care.

XFL: The ultimate "marketing over product" sports league being sold out of bankruptcy to (among others) The Rock

Antitrust: Ben Thompson’s free “weekly” essay last week gave a great breakdown of what happened at the “Big Four” Anti-trust congressional hearing the week before (which seems like years ago now)

Marketing/Advertising:

Google: Google lies about using user signals for determine search placements. Leaked internal documents explain why (anti-trust concerns)

Netflix: Netflix extends "Ta-Dum" sonic logo (sound at the link) for use in movie theaters. Well done. Sonic branding matters, and brands need to change for different formats while maintaining what makes them distinct.

Dark Patterns: Described to include things like "80 people viewing this item", "Low stock", "countdown timers". These things work. We saw them used at Booking.com ten years ago. Building legit versions of these are hard, so companies test the effectiveness with fake versions (display a random number between 2 and 11). They find out the fake version works driving up conversion, but they never bother to prioritize creating the non-fake version. (Wired)

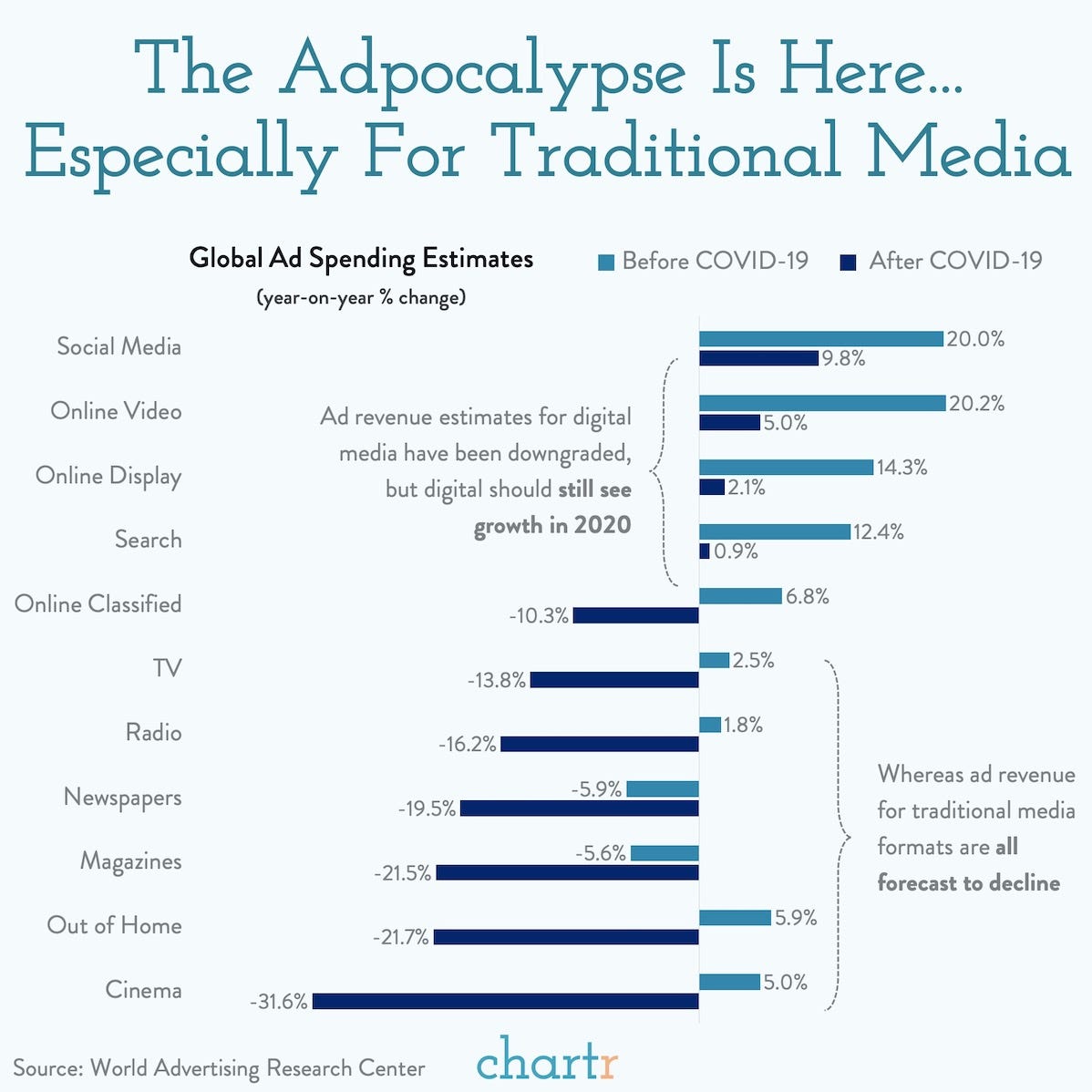

Brand Spend: Newscorp Ad revenue is down 52% YoY in Q2. NYTs ad revenue is down 44%. YoY changes in spend by marketing channel (chart below). Brand advertising is going away during the crisis, while performance ads are holding up, but there could be longer term effects by channel. The Economist Opines: "Eventually, companies that pulled radio and print commercials in these downturns realised they didn’t need them".

Kraft: Once you have near-100% awareness of your brand, the next most powerful lever is increasing the purchase occasions where your product gets consideration. Hence: Kraft Mac & Cheese for breakfast.

ViacomCBS: Launches self-serve ad platform. Convenience matters. A lot!

Burger King: They paid for product placement in Grand Theft Auto, and then created an ad featuring the product placement, then tied in a promotion (for visiting the location in the game), and then rolled out a PR campaign to promote the ad and promotion. Lots of lessons here: When you do something, get as much leverage from it as possible. And ads are becoming a tool for public relations.

Got Milk?: Another example of ads as PR. Dairy Marketing Board has created an ad where an Olympic swimmer swims 25m with a glass of milk on her head. It’s not a great ad. It’s not interesting enough for PR. But the advertisement itself is interesting enough for PR purposes.

Privacy

Firefox: Is now blocking indirect tracking

AdTech: Industry group forms to convince Google and Apple to allow LESS privacy

Media: NPO (Dutch broadcaster) quick using cookies and revenue went UP. Not because of more revenue per customer, but because dramatically lower cost to serve the ads (i.e., not paying the adtech companies). This is the argument against mutual fund managers - not that they are useless, but that they are CLOSE to useless and they just don't add enough value for their cost. Personalization in marketing is the same story. I wrote about it in one of my early Marketing BS essays: “Behavioral targeting is a marketing gimmick that advertisers are willing to pay significantly for (2.7x more per impression), despite being only marginally better at generating revenue (+4%).”

Consumers: More than 40% of Consumers think it’s IMPORTANT that brands personalize their ads (i.e., consumers are asking for LESS privacy)

COVID and Real Fidelity

Behavior: People can’t do many of the things they used to do, so now they are doing more of just about everything they can do. Drinking alcohol. Cycling. Playing Nintendo. Buying health insurance. Committing Murder.

Nike: 30% of revenue is now DTC businesses, “That was their 2023 goal.”

Rent: Dropping dramatically in many big cities including SF -11.1% and Seattle -7.4%

Meetings: Since lockdown meetings up are up 13%, meeting length is down 20%. Total time spent in meetings is down 12%. But average workday is up 50 minutes.

Natural Experiments: Without fans to distract them top tier athletes are getting significantly better at putting balls in hoops and nets.

Retail

Bankruptcies: Lord & Taylor and Tailored Brands (Men's Warehouse) both declared last week. Since the pandemic started 25 major retailers have gone under, including ten in last five weeks. Over 25,000 stores have closed. Note retail space per population in the US is still really high compared to Europe. Lots of room to drop further!

Amazon is negotiating with Simon Property Group to take possession of over 70 Sears and JC Penny locations to become distribution centers. I guess now we know what the one future is for malls in America…. “To replace department stores, mall owners considered schools, medical offices and senior living,” said Camille Renshaw, chief executive officer of B+E, a real-estate investment brokerage firm. “With the current pandemic, industrial is the only thing left now.”($WSJ)

Walmart and Kroger: They bottle their own milk using their market power to work around distributors. This is just like what Amazon does, but they not in the crosshairs now because they aren't "bad companies"

AI and Machine Learning

Google: Their blog explains that changes to their algorithms are “ranked” by humans for quality. They claim that humans are not used for decision making, but that is really arguing semantics. Humans choose the algorithms that choose the search results.

GPT-3: Is going to completely change internal corporate wikis. Instead of looking things up, you will just be able to ask the AI to answer any question you have about the company (and maybe even ask it to impersonate colleague while they are sleeping so you don’t have to wait for the bottleneck)

Marvel Cinematic Universe: I had GPT-3 write plot summaries of the Marvel films that have been announced, but not yet released. I don’t think AI will be all knowing in this iteration…

Careers

Steady Paychecks:Ellen Pompeo, star of Grey's Anatomy, on taking the steady paycheck instead of chasing creative roles. There is lots of talk about "side hustles", but there is real value in a steady job. Related from Marketing BS: How to make $1MM/year in traditional employment

Talent Flows: Where AI talent flows. I expect this is very similar for other top tier talent fields

More

Trust: Trust in brands is decreasing and being replaced by trust in individuals. Great essay. The hard part is still creating awareness.

Product: Chocolate chips are optimized for cost (i.e., the industrial process). What if they were optimized for taste instead? This is what they would look like. They would be much more costly, but would people pay for a premium product they didn’t know they wanted? Also note the PR and co-branding spin on this article: “Designed by a ‘Tesla engineer’”

Psychology: Paul Graham essay on the “four quadrants of conformism”. Recommended.

Too soon: Documentary on General Magic and the attempt to create the smartphone in the 1990s

Fun

Day at the beach: Remastered film from 1896 [video]

Bend it like Beckham: Incredible kick. Physics is amazing. [video]

Constraints: Yesterday marked the 60th Anniversary of Green Eggs and Ham - which was written on a bet that Seuss could not write a book with only fifty single-syllable words. More fascinating history here in a Twitter thread

LinkedIn: Most discussed topics on the platform during the pandemic

Career Opportunities

GSI: CEO role. New York.

VillageMD. CMO role. Chicago.

Undisclosed: CRO role. Flexible location, but likely somewhere on the east coast. Sells software to help colleges increase revenue. PE-backed. Set up fro growth. Needs experience selling to Deans. Reply to this email if interested.

Keep it Simple,

Edward